We have all types of clients, typically ranging from busy career professionals to those enjoying their retirement years. Everyone is different, with different needs and attitudes towards their finances. My team’s knowledge and experience allows us to tailor client portfolios to meet their growth and income goals.

What is common among all of our clients is that before joining us they reached a point in their lives when they recognized that they did not have the time, interest, knowledge, or skill to optimize their investment portfolios. They came to the realization that professional, disciplined management of their wealth was warranted to maximize their returns and relieve them of the hassle, stress and time required to manage their own finances. They knew they needed to find a trusted advisor.

When we are contacted by a prospective future client, we always have an introductory interview to explain our investment philosophy and ensure a good fit of expectations and communication style. We believe our approach to investing offers the most value to clients who are seeking an experienced, pragmatic, and careful advisor that they can confidently trust to carry out the day-to-day management of their wealth - knowing that all portfolio choices are firmly grounded in their investment plan which is carefully monitored and adjusted over time to achieve their goals. As such, our client relationships are built on a foundation of trust which begins at our first meeting.

Our investment philosophy is relatively simple:

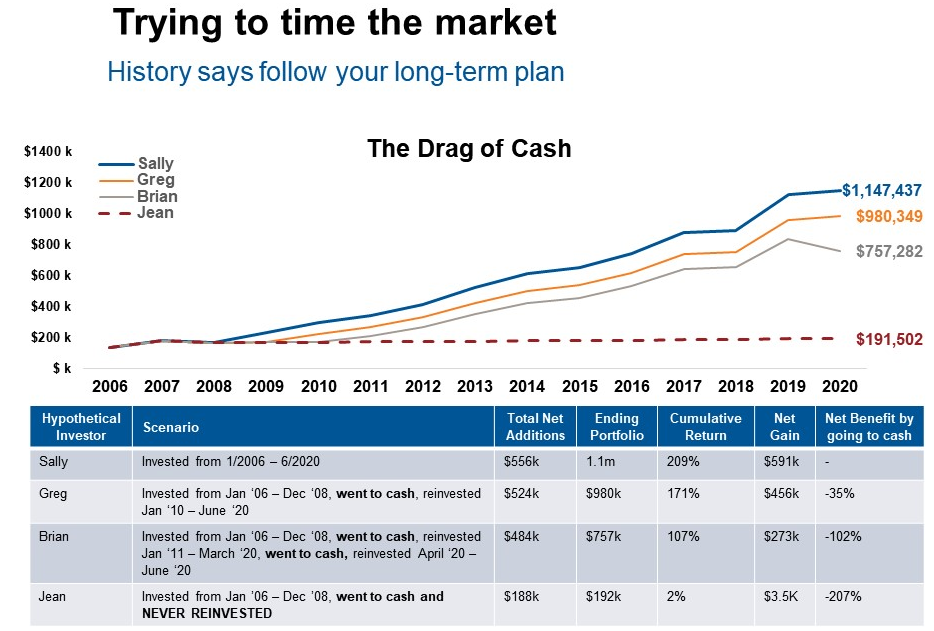

We do not try and time markets.

We do not know anyone who has a successful, proven history of being right when timing markets. We agree with the mantra: “It is time in the market, not timing the market”, that grows portfolios. Our approach is to find the right mix of equity and fixed income for each client so that they are comfortable when markets fluctuate - which they always do!

Source: Morningstar Rebalance monthly. Net Benefit by going to cash: Cumulative return of Greg, Brian, or Jean minus cumulative return of Sally. Balanced Portfolio: 60% S&P 500 Index, 40% Bloomberg Barclays U.S. Aggregate Bond Index. Cash:1.25%. For illustrative purposes only.

We do not believe in “buy and hold”.

We monitor positions daily and make changes to client portfolios based on our research. Between quarters, the change may be to buy or sell a complete position, or to reduce/increase the percentage of the position within a client’s overall holdings. Each quarter, we do a review of every client portfolio and we follow a rigorous discipline of rebalancing all portfolios to “sell high” and “buy low”.

We will invest your hard earned money, not gamble it.

If you are looking for the next winning penny stock or like to place large bets we are not the right fit for you! We follow strict risk management guidelines so that your assets will grow steadily over time, not just when the stars align!

We believe in maximizing portfolio value for our clients without wasting their personal time.

Portfolio Managers make investment decisions without contacting and obtaining approval from clients on every trade – of course, all the while keeping within strict discretionary risk guidelines and oversight monitoring protocols within RBC Dominion Securities. This ability allows us to focus our efforts on building client portfolios and helping clients with planning rather than spending time on non-productive administrative tasks which do not add value. Also, we can ensure our clients do not miss time-sensitive market opportunities and are not constantly bothered with every investment choice, however minor. We appreciate that our clients have busy lives and they appreciate that we bring them peace of mind that their finances are in good order without having to request approval of every trade.

With our approach, we have found that we work most successfully with clients who are comfortable with our team making day-to-day investment decisions. If you are looking for an investor advisor who you need to simply execute your trade decisions or if you want a highly collaborative decision-making process on investment decisions, we would be happy to recommend someone who would better suit your needs.